Budget 2015: George Osborne's tax credit cuts will 'affect more than seven million children'

Government advisers on child poverty warn 45% of working families will be hit

More than seven million children will be hit by the proposed cuts to tax credits to be announced in George Osborne’s post-election Budget on Wednesday, the Government’s advisers on child poverty have warned.

A new analysis by the Social Mobility and Child Poverty Commission found that any cut in tax credits would reduce the incomes of 45 per cent of working families. The vast majority – 72 per cent – of the losers earn less than £20,000 a year. Only 7 per cent of them have earnings of more than £30,000 a year.

Two thirds (4.9 million) of the 7.5 million families with children affected have someone in work, while 2.6 million are in workless households relying on state benefits. The figures will fuel criticism that the move will hit the “hard-working families” which the Conservatives champion.

Alan Milburn, the former Labour Cabinet minister who chairs the commission, told The Independent: “The Prime Minister is right to argue that a serious ‘one nation’ agenda requires far more to be done to help the poorest families share in the proceeds of economic growth.

What does five more years of the Tories mean for Britain?

Show all 8“With two in three poor children now in families where someone is in work, the priority has to be to tackle in-work poverty. That’s why the Government should resist making welfare cuts that fall exclusively on the working poor. The risk otherwise is that its approach of making work a route out of poverty will be fundamentally undermined.”

Mr Milburn joined growing calls on Mr Osborne to cushion the blow of lower tax credits by urging employers to pay the Living Wage which, at £7.85 an hour and £9.15 an hour in London, is higher than the £6.50-an-hour national minimum wage.

He added: “At a minimum, the Chancellor must act to balance any cuts in tax credits for working families with a new Government drive to champion the Living Wage, to increase Universal Credit work allowances and to enhance skills training budgets.”

Budget 2015: Osborne to cap family benefits at £23,000

The deficit will again play central role as Osborne eyes 2020

Osborne to axe subsidies for higher income earners in social housing

This graph shows the poor are paying more than the rich in tax

A think tank has warned Mr Osborne that tax credit cuts could stall the recovery. Gavin Kelly, chief executive of the Resolution Foundation, said: “There has been welcome return to rising living standards in recent years.

“But major reductions in working age welfare support over the next two years risk putting the brakes on recovery for millions of low income households. With some families potentially facing losses of up to £1,700 from cuts to child tax credits alone, they are unlikely to be able to earn their way of out of this fresh income squeeze.”

The Institute for Fiscal Studies said in May that reducing tax credits to their 2003-04 levels would push 300,000 more children into poverty.

David Kirkby, senior research fellow at Bright Blue, a Tory modernisers’ think tank, said: “The scale of the proposed cuts to tax credits, which are primarily claimed by working households, could push more children into poverty. Reductions in welfare expenditure should be more evenly distributed across the whole population.”

Budget 2015: Osborne urged to reverse public health cuts

Banks tell Osborne to rethink the banking levy

Stamp duty unlikely to be changed by Osborne

300,000 people plead with Osborne not to cut tax credits

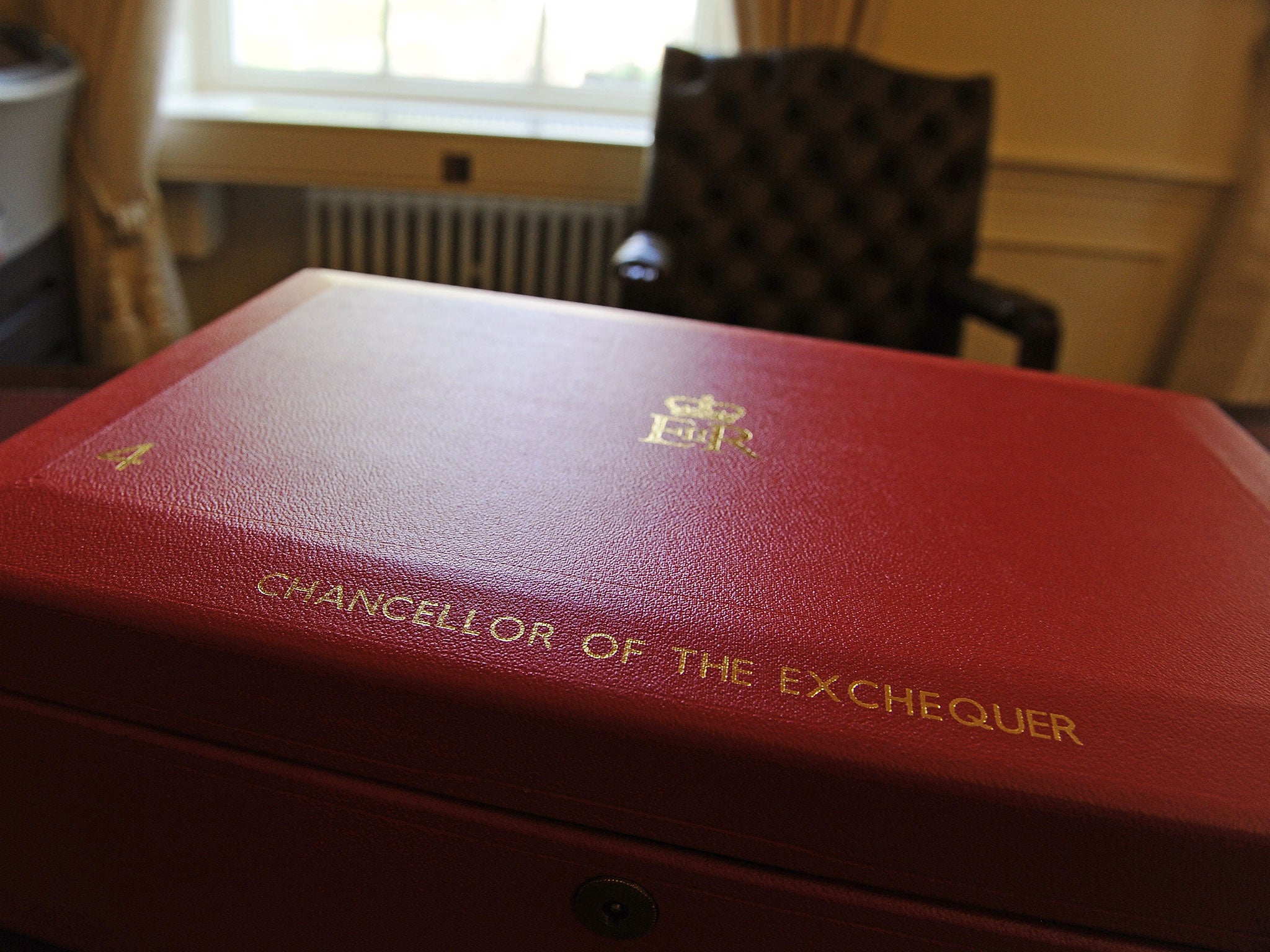

Mr Osborne confirmed that the first Conservative-only Budget since 1996 would reduce tax credits, saying the cost had ballooned from a couple of billion pounds to £30bn a year.

Osborne allies pointed out that the cap on the amount one family can claim in benefits in a year does not affect households in work, only workless ones.

The Chancellor reacted coolly to the calls for the Living Wage to be extended. He told the BBC’s Andrew Marr Show that the best way to boost earnings was “to reduce taxes on working people”.

Mr Osborne could speed up the promise in his party’s manifesto to raise the £10,600 personal tax allowance to £12,500 a year by 2020. He appeared to dismiss demands by Tory MPs for him to reduce the top rate of tax on incomes over £150,000 a year from 45p to 40p. He has identified the £12bn of welfare cuts promised in the manifesto and said they would help to create “a welfare system that is fair not just to those who need it but to those who pay for it”.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies