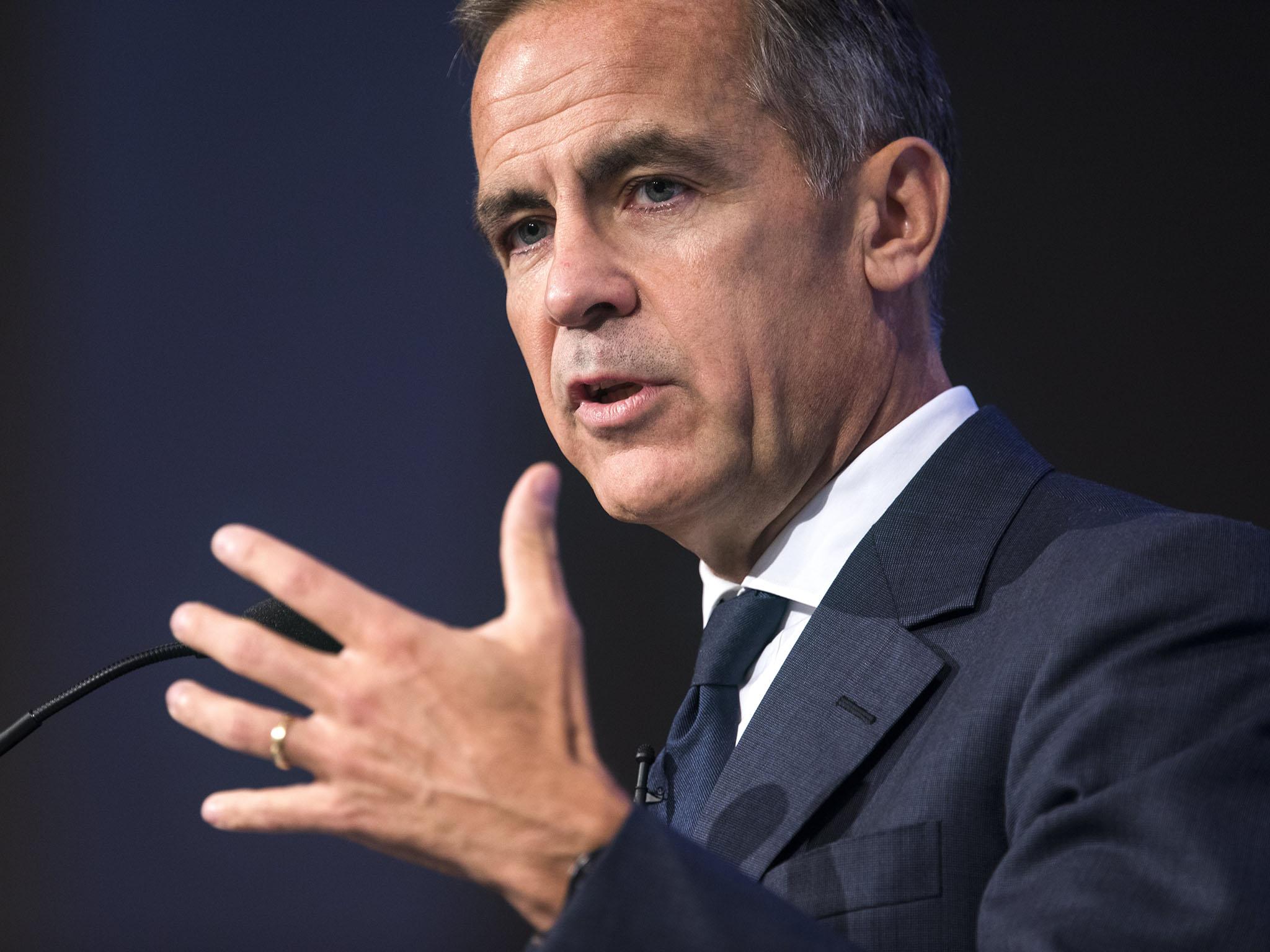

Bank of England Governor Mark Carney says inflation has further to rise after hitting highest level since 2012

Inflation hit 3 per cent in September, its highest level in more than five years, driven by more expensive food and fuel

Consumers could be in for further painful price increases after Bank of England Governor Mark Carney told MPs on Tuesday that inflation has not yet peaked.

Inflation hit 3 per cent in September – its highest level in more than five years – driven by more expensive food and fuel.

Mr Carney warned it was “more likely than not” that prices would increase further in October and November and said that the Bank’s Monetary Policy Committee (MPC), which sets interest rates, expects inflation to remain above the Treasury’s 2 per cent target for three years.

That would mean workers are likely to continue see their wages squeezed if pay rises remain at current levels.

Mr Carney also stressed the importance of avoiding a so-called hard Brexit, without a transition agreement.

He said: “There’s a very limited amount of time between now and the end of March 2019 to transition large, complex institutions and activities. A transition agreement is in everyone’s interests.”

His comments came as the Consumer Prices Index (CPI), which measures the changing cost of a “basket” of goods and services, rose to its highest since April 2012, official figures revealed on Tuesday

Higher inflation makes it more likely that the Bank of England will raise its benchmark interest rate from a record low of 0.25 per cent when the MPC meets next month. A rise in rates makes borrowing more expensive, typically reducing demand in the economy and easing inflation.

Mr Carney provided a further hint on Tuesday that the Bank was ready to raise interest rates soon. He told the Treasury Select Committee: “Having used up more spare capacity, having seen some evidence of building domestic pressures, the judgment of the majority of the committee is some raise in interest rates over the coming months may be appropriate.”

A rise would help bolster the weakened pound but would also run the risk of choking off overall economic growth at a time when activity is already weakening markedly because of uncertainty over Brexit.

A base rate hike would filter through to mortgage rates, increasing monthly payments for those on variable-rate home loans or coming to the end of a fixed-interest deal.

Aside from impacting interest rates, September inflation figures also impact a range of tax and benefit payments.

Those collecting the state pension will continue to see payments protected against rising inflation. Government pension payments will increase by at least 3 per cent next year thanks to the Government’s “triple lock”, which guarantees that payments increase by whichever is the highest out of the September CPI rate, average earnings or 2.5 per cent.

However, businesses face a squeeze as the separate Retail Price Index measure of inflation hit 3.9 per cent last month. September’s RPI will be used to set business rates next year.

The inflation figure also means that 10.5 million households face losing an average reduction of £450 per year to their benefits in real terms, the independent Institute for Fiscal Studies calculated.

Normally the September inflation figure is used to adjust benefits thresholds but current government policy is to freeze most working-age benefits until March 2020.

Business news: In pictures

Show all 13Prices have risen sharply since the Brexit vote in June last year as the value of the pound has fallen against other major currencies, causing the prices of imports to rise.

Some analysts predicted UK exports would also rise to counterbalance the effect but recent data shows this has not happened.

Laith Khalaf, a senior analyst at Hargreaves Lansdown, said it was “important to keep perspective” on the impact rising prices would have on consumers.

“The pound in your pocket is depreciating, as the rising price of goods continues to chip away at its value. Consumer spending remains remarkably resilient in the face of inflationary pressures and weak wage growth, but the current squeeze on household budgets is a slow burner, as it takes some time for economic reality to hit home,“ he said.

“Employment remains high and borrowing costs are low, for the time being at least.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies