Bank of England covered up failure of Government fund-raising effort in First World War

Rather than admit the £350m placing had failed – potentially a propaganda coup for Germany – the Bank secretly bought up £113.5bn of the bonds

The Bank of England covered up a failure by the government of the day to raise enough money from private investors to fund a major borrowing programme at the outset of the First World War, new research has uncovered.

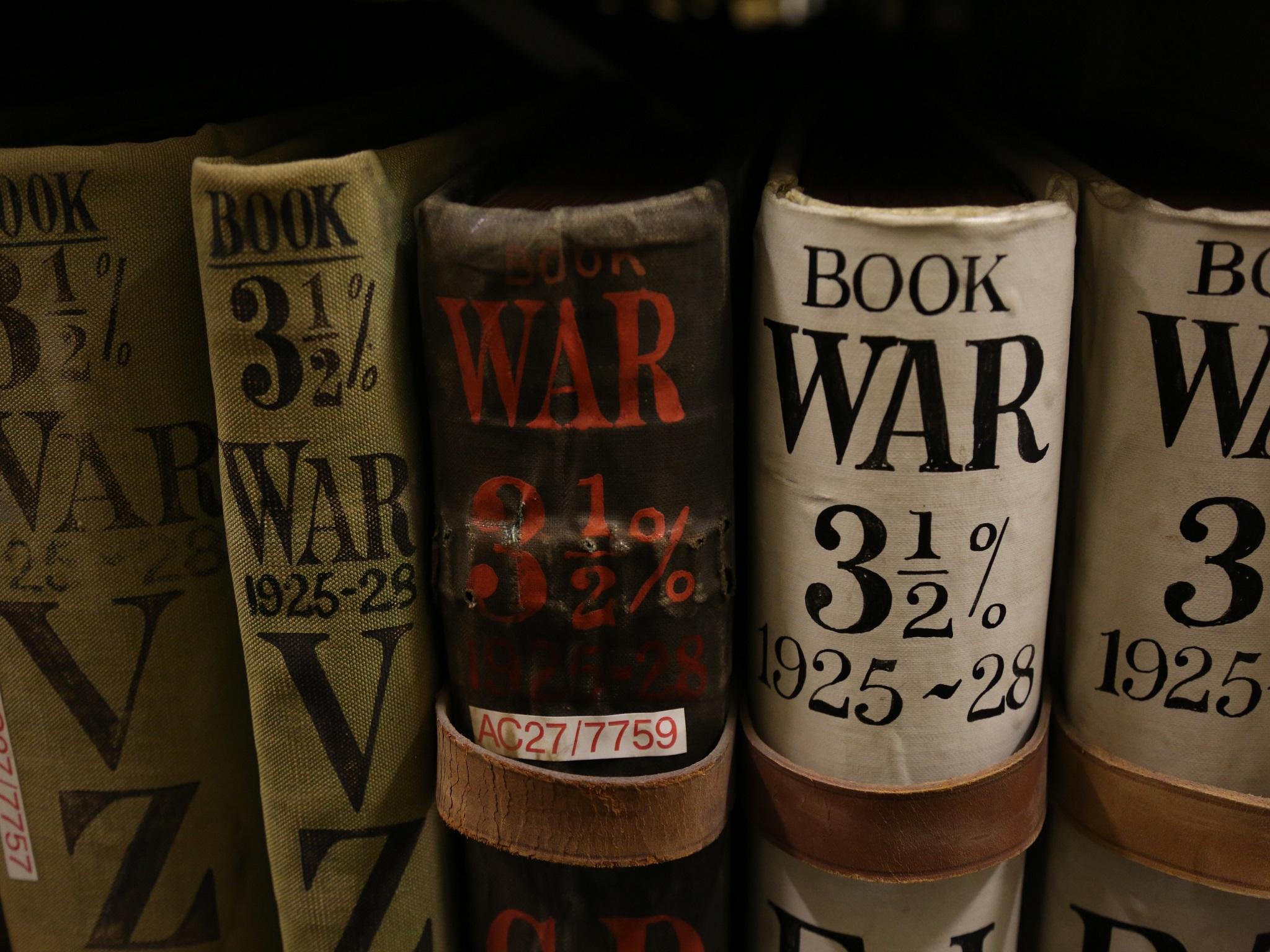

In 1914, after Britain had declared war on Germany, the Government sought to fund its ballooning budget deficit by raising £350m, equivalent to around 15 per cent of UK GDP at the time, in the form a new "War Loan".

This was a bond which would pay the relatively generous interest rate of 4.1 per cent a year for 10 years.

But while private investors had initially been expected to contribute £250m of the funding they only made offers for around £91m.

Rather than admit the placing had failed – potentially a propaganda coup for Germany and a blow for domestic morale – researchers have found that the Bank of England, then a privately-run institution, secretly bought up £113.5bn of the bonds, selling other assets to raise the money.

The purchases of the bonds were registered under the personal names of the Bank’s chief cashier, Gordon Nairn, and his deputy, Ernest Harvey, in order to disguise the identity of the true buyer – and the bonds were falsely described as “other securities” rather than “government securities” in the Bank’s accounts.

The public were led at the time to believe that the fundraising had been a major success, with a piece in the Financial Times reporting that it had been over-subscribed by £250m.

“Revealing the truth would doubtless have led to the collapse of all outstanding War Loan prices, endangering any future capital raising. Apart from the need to plug the funding shortfall, any failure would have been a propaganda coup for Germany,” the researchers, from Queen Mary University of London, wrote, in a post for the Bank of England’s ‘Bank Underground’ blog.

Subsequent War Loans offered even higher interest rates to investors, with the 1917 version, which raised £2bn, offering 5.4 per cent a year.

But from 1915 the Government helped ensure it would receive sufficient demand for its debt by banning UK investors from purchasing most new private securities.

The Bank of England also used its reserves to provide capital to the Government on several other occasions during the Great War.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies