Four morose men are drinking in a pub when Bill Gates walks in. "Cheer up lads," exclaims one of the men. "The average wealth of the five of us has just gone through the roof."

It's an old joke, but it's worth retelling because it hammers home a truth in a way that a million statistical expositions never will. Averages, as the joke demonstrates, can be misleading. They tell us something, but not everything. When we're talking about rises and falls in wealth and incomes, the shape of the distribution matters as much as the headline average.

Bill Gates's enormous wealth does not make his fellow drinkers any better off. It's a good lesson to recall as the fanfare heralding "rising real wages" rings in our ears.

Yesterday's report from the Office for National Statistics (ONS) showed that average, annual total-pay growth between December and February was 1.7 per cent, matching the annual rate of consumer price inflation in February. It is a welcome moment given that pay growth has lagged rises in the cost of living for most of the past four years, pointing to falling real (inflation-adjusted) wages.

The trends are encouraging too. Pay growth seems to be rising, up from increases of less than 1 per cent last year. And inflation seems to be moderating too. Earlier this week the ONS reported that inflation dipped further to 1.6 per cent in March, having been as high as 2.8 per cent this time a year ago.

But we should beware simple averages when it comes to pay rises. It's crucial to bear in mind that what we are looking at in these particular pay figures are mean average total pay. In other words: all the pay packets in the economy added up and then divided by the number of workers.

If pay for the top 1 per cent of earners is rising fast while the pay of the rest of the workforce remains stagnant, this measure of the average will rise. What happens if we examine the worker bang in the middle of the pay distribution, also known as the median average, which is a rather better gauge of what is happening to average pay?

The ONS does look at median pay too, but it reports this figure less regularly. Rather than monthly results, it spits out a figure every December which refers to pay in the previous April.

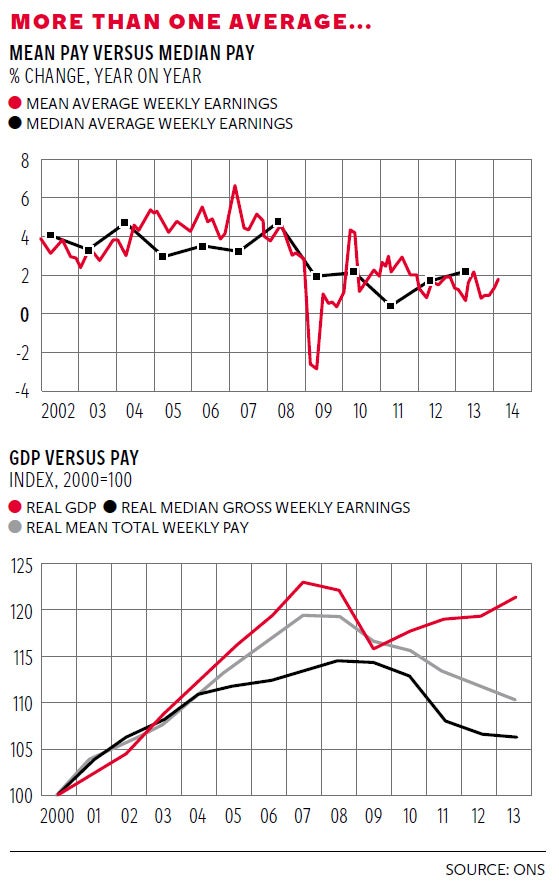

What the first chart demonstrates is that median-pay increases have frequently been lower than the mean-pay increases over the past decade. This gap was especially large in the years leading up to the 2008 financial crisis. There was also a sizeable divergence in 2011, although the median-mean gap has fallen since then. This gap matters since it implies wage inequality is growing – it reflects the fact that pay for the financial-sector workers and chief executives has been rising much more quickly than for the rest of the working population. To put it crudely, Bill Gates has been getting richer but the rest of the people in the bar haven't.

George Osborne made a speech in Washington at the weekend in which he asserted that the link between economic growth and employee compensation is as strong as ever and that, as the economy recovers, living standards will inevitably rise. The Chancellor cited the fact that when one factors in all forms of remuneration, such as employers' contributions to company pension schemes, the share of Britain's national income going to workers – as opposed to corporate profits – has remained constant in recent years.

Yet when he spoke of "employee compensation" he was talking in aggregates. As the second chart shows, when one examines the progress of median pay (adjusted for consumer price index inflation) over the past decade, it has lagged behind both mean pay and also growth in the wider economy. The gap between mean pay and GDP growth may, as the Chancellor says, be mostly explained by other forms of workers' benefits. But a clear gap has opened up between the performance of the total economy and the pay of those actually in the middle which cannot be so easily explained away.

It is possible that the Chancellor is correct that average living standards will pick up as the economy grows. However, he and we won't be able to judge this until we see what happens to median pay. It is certainly premature to herald a recovery based on a single month's mean average figures. The Resolution Foundation think-tank fears the pre-crisis pattern of weak median pay relative to broad economic growth will reassert itself over the coming years.

There are other complications, too, in this story. None of the various surveys the ONS uses to compile its headline pay figures covers the self-employed, who have soared to a record 15 per cent of the workforce in recent years. It is therefore hard to say what has happened to pay in this group, although there is some evidence that many people registered as self-employed are struggling.

The rate of real wage growth also changes considerably depending on which inflation measure (consumer prices or retail prices) is used for the adjustment. And when one is talking about living standards it is preferable to look at total household incomes, which takes into account taxes and benefits received, rather than pay. The ONS says median incomes of non-retired households fell by 6.4 per cent between 2007/08 and 2011/12. This is all context of course – but as Bill Gates's drinking companions could tell you: context is important.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies