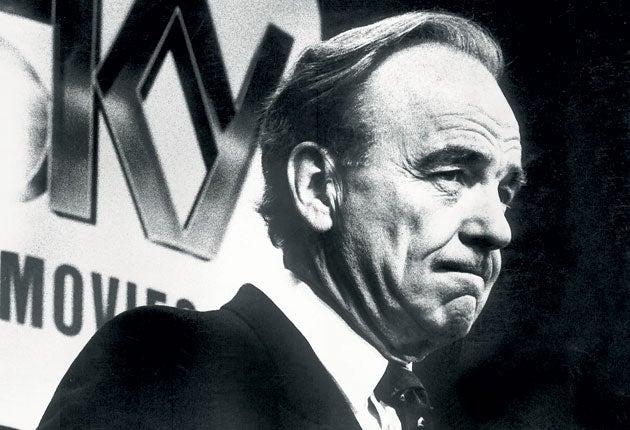

Murdoch prepares to lock horns with cable

News Corp's bid for Sky is back on the agenda as the media giant prepares to go to the regulator. Nick Clark reports

News Corporation's tilt at full control of BSkyB dropped off the radar over the summer, as the prospective bidder finalised its regulatory submission to the European Commission.

The US group, headed by media tycoon Rupert Murdoch, tabled a 700p per share bid in June to take its 39.1 per cent stake to full ownership, valuing the broadcaster at about £12bn. Since then the silence from the two principal players, as regulatory forms are being filled, has been replaced by calls from Sky's independent board and shareholders for and increased bid, and its rivals calling on Business Secretary Vince cable to block it altogether. This week, News Corp is expected to notify the European Commission of its intended approach for Sky.

That the submission has taken four months is not uncommon, according to sources close to the company. The Commission demands answers to several of the crucial competition questions before official notification, and the document cannot be posted until the regulator is satisfied.

As soon as the official notification is made later this week or early next, the regulatory clock starts ticking both in Brussels and in London.

The European Commission will look at the deal exclusively on competition grounds. Following a change in corporate ownership, the Commission wades in when the combination of the two companies – with European operations – have worldwide revenues of more than €5bn (£4.33bn). Either that or the companies' turnover in the EU is €250m each. A News Corporation takeover of Sky would meet either criteria for an investigation, and the Commission has 25 days to decide whether to move to a deeper investigation. Analysts expect the EC to move to a more detailed phase II investigation.

Following a formal takeover notification, the Commission sends out notifications of its own to the member states that are affected. In this case, the Office of Fair Trading has the right to request that the competition enquiry is brought back to the UK. Sources close to the enquiry do not expect the OFT to become involved.

So if News Corp can convince the Europeans that there is no competition case to answer, it is still not guaranteed a clear path to buy Sky. In parallel to the Commission's preliminary investigation, the UK has to decide whether to issue an intervention notice of its own. The Government also has 25 working days, but a spokeswoman for the Department of Business, Innovation and Skills said a decision would be taken in 10 days. The issue facing the Government is whether such a deal harms so-called "media plurality". But, as BIS admitted, defining this issue can be "somewhat nebulous".

The Government can step in and block the deal under the 2003 Communications Act citing public interest. Sources working on the deal were adamant the Government should not become involved: "The threshold is pretty high; there are clear guidelines under the act. If Vince Cable intervened it would be under exceptional circumstances." An investigation was most recently initiated on these grounds after Sky bought a 17.9 per cent stake in ITV in 2006. It was forced to sell that stake down earlier this year.

If BIS decides to investigate, the case will be examined by Ofcom, the media watchdog. Should Ofcom decide there is a case to explore, the Competition Commission will be brought in to fully investigate. All recommendations will then be put before Mr Cable, who has the ultimate decision whether to block the merger. News Corp fears that the decision to investigate will become a political one, not taken on what it believes are the hard facts.

The controversy around the deal erupted in September following an explosive report released by respected media analyst Clare Enders, founder of Enders Analysis, which called for the deal to be blocked. In the wake of the note, several media organisations including the BBC and ITV joined together to urge Mr Cable to step in and block the deal. Lord Fowler also lent his support. They fear that any deal to fully combine the owner of The Sun, The News of the World, The Times and The Sunday Times with Sky News would drown out other voices in the UK media market.

News Corp has outlined a robust defence to the competition and the plurality arguments. It said that when the Competition Commission studied Sky's stake in ITV, the regulator viewed it and News Corp as one entity. "That is a strong precedent and it is hard to argue that things have changed," one insider said. On plurality, it argued that in the BBC and ITV there are strong broadcast competitors, adding that seven national newspaper rivals, guarantee a diverse range of voices.

Ms Enders suggested that one threat could be the merger of Sky News with the newsrooms of The Times or The Sun. Once again, sources close to the companies shrugged off the charge saying that Sky News was subject to regulatory mechanisms that would prevent such a move.

Critics fear the real damage the deal could do, certainly to its print rivals, would be in offering bundled packages. News Corp could offer cheaper deals for subscriptions of The Times, for example, for every Sky subscription. This remains a fear, although would more likely come under a competition review than one covering plurality.

News Corp would say nothing yesterday other than: "We've yet to finalise our submission. We trust when appropriate that the Business Secretary will make his decision on the merits of the case and bear in mind that many complaints are from commercial rivals."

Paul Richards, an analyst at Numis, said: "I'm sure it will go through, although it's safest to assume everyone who can look at it, will look at it. The deal should still be done by June."

Anatomy of a merger

June 2010 News Corp moves to take full control of BSkyB, in which it holds a 39.1 per cent stake, with a 700p per share offer. It values Sky at £12.2bn

June 2010 Independent directors reject the bid but surprisingly add they would back an offer of 800p per share.

July 2010 A Nomura analyst says News Corp should pay £10 per share for the deal, valuing Sky at £17.5bn.

July 2010 News Corp sets about compiling notification of its planned bid to present to the European Commission.

November 2010 After what one insider describes as "to-ing and fro-ing" the company is ready to file the merger notification with the Commission.

November 2010 Upon filing, the clock starts ticking for both the European Commission and the Department for Business, Innovation and Skills to launch investigations. They have 25 days.

November 2010 The EC can decide to move to a phase II investigation over competition. Vince Cable can pass the investigation to Ofcom, which can then pass it on to the UK Competition Commission over media plurality threat.

Early 2011 Mr Cable and the EC must make a decision to block the deal or not.

June 2011 The deal is likely to be sealed, according to Paul Richards, an analyst at Nomura.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies